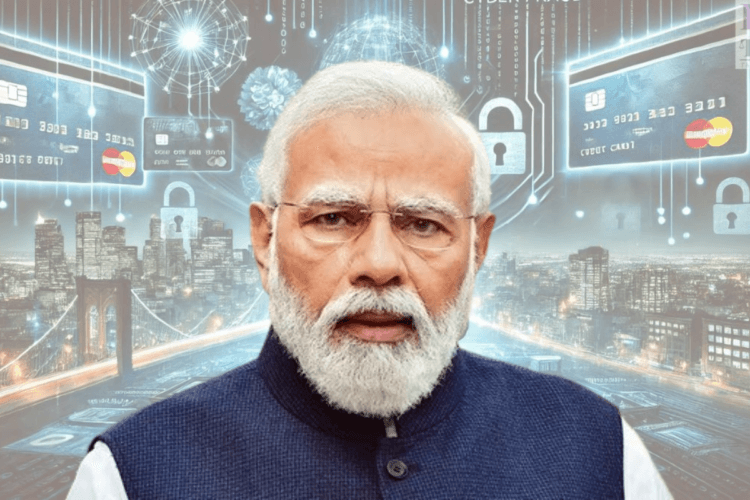

Beware of the “Digital Arrest” Scam: What You Need to Know

In a recent episode of his monthly radio program “Mann Ki Baat,” Prime Minister Narendra Modi raised awareness about a new and deeply concerning cybercrime trend—the so-called “digital arrest” scam. Fraudsters impersonating police and customs officials call unsuspecting individuals, claim they’re “under digital arrest” for supposed criminal activity, and use this fabricated charge to demand hefty payments. PM Modi clarified that “digital arrest” has no basis in Indian law, describing the scammers as “enemies of society” who prey on public fear to exploit people’s hard-earned savings. With this scam proliferating across India, it’s crucial to understand how it operates, its impact on victims, and ways to protect oneself.

The Modus Operandi of the Digital Arrest Scam

The digital arrest scam has grown into a sophisticated operation. Fraudsters posing as representatives from courier companies, law enforcement, or customs agencies typically start the call by informing the victim about an illegal package or transaction under their name. Once they’ve gained the victim’s attention, the scammers escalate the threat, claiming the individual is implicated in crimes such as money laundering, smuggling, or international fraud. A fabricated “digital arrest warrant” is then issued over the phone, with threats of jail time, police visits, or court cases unless the victim pays a substantial fine.

The scammers use convincing language, employ official jargon, and even access sensitive personal details, making the deception more credible. According to reports, the scam often involves linking the victim with supposed high-ranking officials or multiple “departments,” creating a psychological trap that intimidates the victim into compliance .India Today.

Why Digital Arrest Scams Are So Effective

Digital arrest scams exploit fear, urgency, and a lack of awareness among the general public. With cases of online fraud already on the rise, scammers rely on several tactics that make these scams effective:

- Psychological Pressure: Fraudsters often create high-stakes scenarios where victims believe they must comply immediately to avoid severe consequences. This urgency can prevent victims from taking a moment to verify the legitimacy of the call.

- Personal Information Access: Scammers frequently have access to private data—like Aadhaar numbers, bank details, or contact lists—enhancing their credibility and manipulating victims further.

- Social Isolation Tactics: In extreme cases, scammers instruct victims to isolate themselves from friends and family under the guise of protecting “national security,” which prevents them from consulting others who could expose the scam.

- Data Breaches Fueling Scams: Digital criminals often exploit personal data leaked through cyber breaches. In one case involving a prominent journalist, the scammers had access to her Aadhaar details, which helped them manipulate the situation to their advantageIndia Today.

Real-Life Examples of the Digital Arrest Scam

The following recent incidents illustrate the dangers and financial devastation this scam can cause:

- The Chief Justice Impersonation Case: In Ahmedabad, scammers posed as representatives of the judiciary, even using the Chief Justice’s profile picture to convince an elderly man that he faced criminal charges. Over several video calls, they coerced him into paying Rs 1.26 crore. The scammers used elaborate methods, including video calls with fake officials, to maintain the deception.

- Mumbai Businessman’s Experience: In another instance, a Mumbai businessman received a call from a scammer posing as a courier service representative, informing him of a suspicious package linked to his name. The call was escalated to a fake police officer, who threatened the businessman with immediate arrest unless he paid a fine. Panicked, the businessman complied, only later realizing he had been duped.

The Broader Context of Digital Scams in India

According to NCR police, 600 cases of digital arrest scams were reported in just three months in 2024, with average losses of Rs 20 lakh per victim. Alongside digital arrest scams, other types of digital fraud have emerged, such as:

- Fake Loan App Scams: Fraudulent loan apps exploit financial hardship by promising quick loans at low interest rates but later misuse victims’ data to harass or blackmail them.

- E-commerce Phishing Scams: Fake e-commerce websites lure people with too-good-to-be-true offers, only to steal their money or personal information. These scams are particularly rampant during festivals or major online sale events.

- Credit Card Fraud: Scammers posing as bank officials request sensitive information, like OTPs, to “verify” accounts, only to use the data to make unauthorized transactions.

Government and Institutional Responses

In response to the rising tide of digital scams, several government and law enforcement bodies have stepped up efforts to educate the public and implement cybercrime reporting channels. Key measures include:

- Public Awareness Campaigns: The Ministry of Electronics and Information Technology (MeitY) and various state police units have rolled out awareness campaigns warning people about common scams, including digital arrests.

- Dedicated Helplines and Portals: The Indian government has launched dedicated helplines, such as 155260 for reporting cyber fraud, and portals like the National Cyber Crime Reporting Portal, where individuals can report incidents promptly.

- Official Statements from Companies: Organizations like FedEx and DHL have issued statements reminding the public that they never request personal information through unsolicited calls or emails. This measure aims to prevent their brand names from being exploited by scammers.

Protecting Yourself from Digital Scams

Here are essential tips to stay safe from digital arrest and other cyber scams:

- Don’t Share Personal Information Over the Phone: Genuine law enforcement agencies will not ask for personal details like Aadhaar numbers, bank account information, or OTPs over unsolicited calls.

- Verify the Source: If you receive a suspicious call, contact the company or agency directly using official contact details available on their website. Do not trust caller ID information, as scammers can easily spoof it.

- Beware of High-Pressure Tactics: Scammers use urgency to manipulate their targets. Always take time to verify claims before responding.

- Report Suspicious Activity: If you encounter a potential scam, report it immediately to the cybercrime helpline or through the National Cyber Crime Reporting Portal.

- Enable Two-Factor Authentication (2FA): Strengthen your online accounts with 2FA, which can help prevent unauthorized access.

- Stay Informed: Regularly update yourself on new types of scams and digital threats by following official cyber security advisories.

Conclusion

The “digital arrest” scam and similar fraudulent activities have emerged as serious threats to financial security in India, exploiting fear, misinformation, and the widespread digital adoption of financial transactions. By staying informed, vigilant, and cautious, individuals can protect themselves and their loved ones from becoming victims of such scams. Prime Minister Modi’s call to action in “Mann Ki Baat” underscores the need for public awareness and caution in an era where digital threats can appear all too real. As scammers continue to evolve their tactics, a proactive, informed approach remains the best defense.

Comments 4